As the Financial Times and Bloomberg report on Argentina’s push to recalibrate its currency regime, rebuild reserves, and test demand for dollar debt . . . a more fundamental ledger is often treated as secondary: the difference between an economy that must constantly source external dollars to keep the system running, and one that systematically reduces its need for them.

The government’s near-term focus is the External Dollar Ledger: exchange-rate management, reserve accumulation, market access, and credibility. Financial Times and Bloomberg reporting on the move to widen the peso band in line with inflation captures that logic precisely: stabilise expectations; rebuild buffers; avoid the next run.

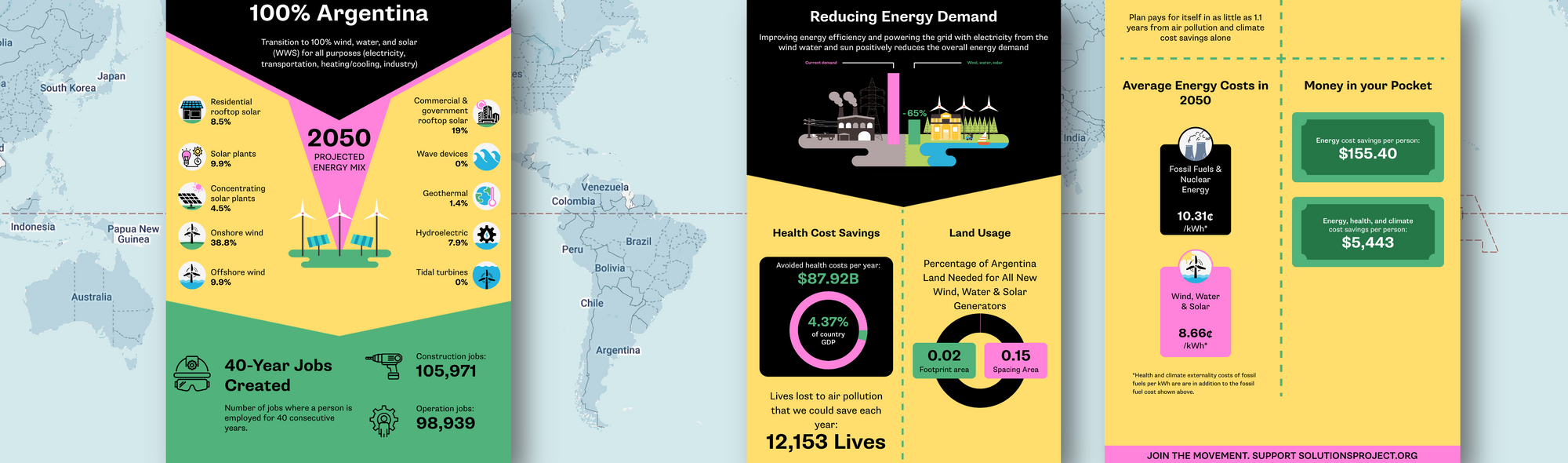

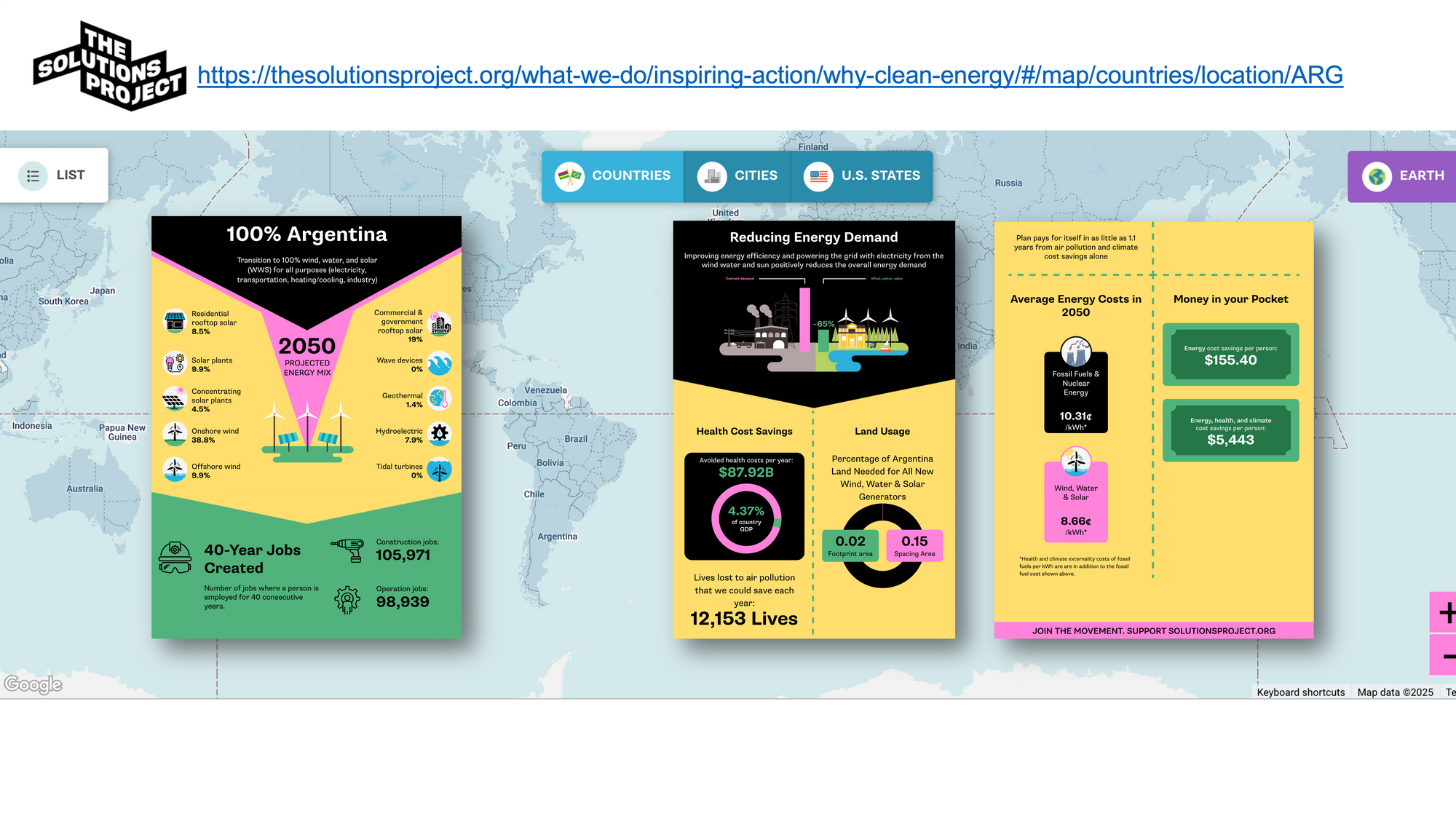

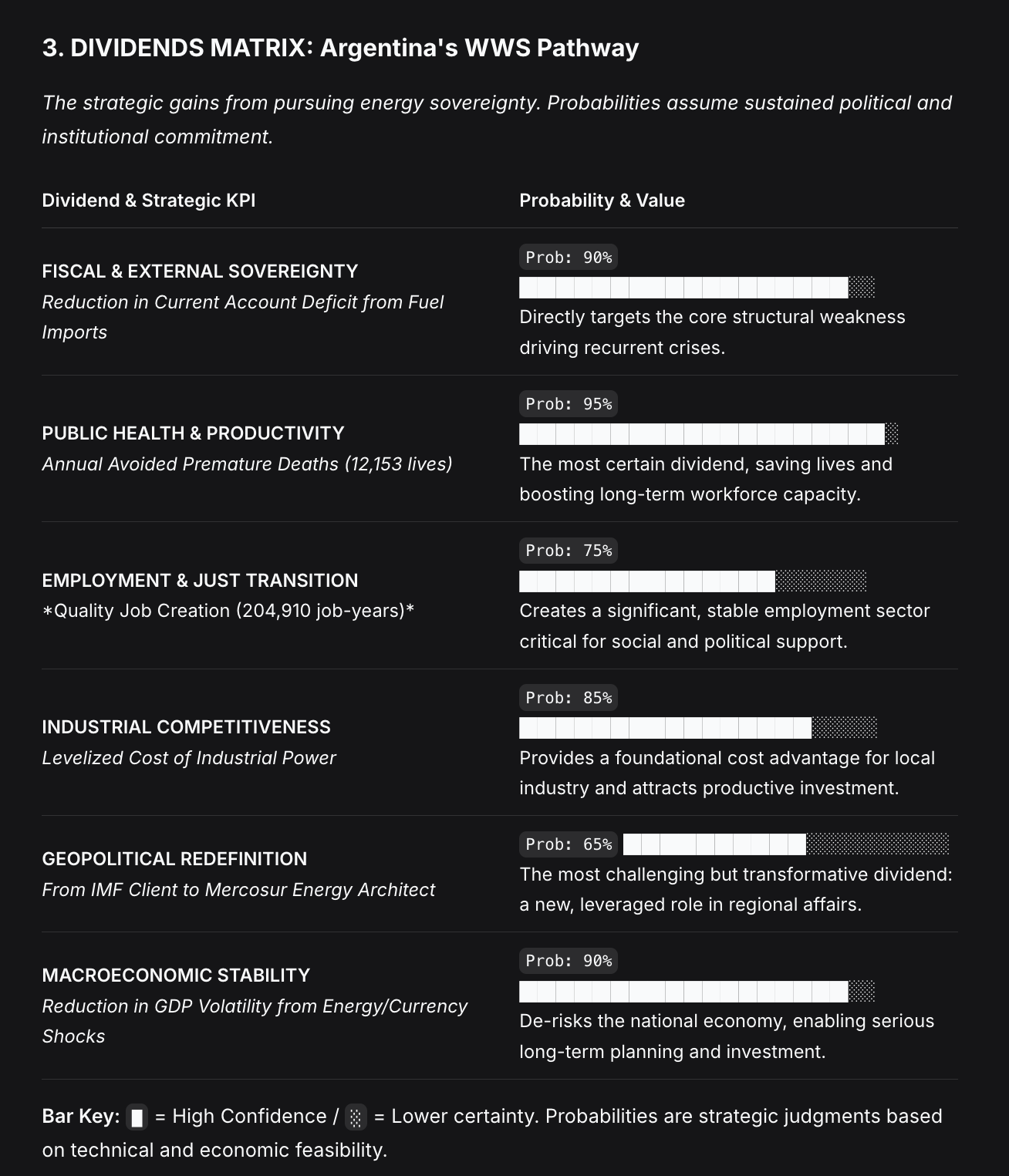

A parallel ledger exists: the Internal Value Ledger. The Solutions Project’s 100% wind, water and solar pathway for Argentina (2050) translates energy sovereignty into recurring national value: avoided health costs, lives saved, lower system energy costs, and long-term employment . . . https://thesolutionsproject.org/what-we-do/inspiring-action/why-clean-energy/#/map/countries/location/ARG

Two economic models . . . two kinds of “return”:

(A) The current path: scarcity management through financialisation and extraction:

‣ Primary indicators: net reserves, spreads, bond deals, the credibility of the currency band.

‣ Growth channel: volatile commodity and capital cycles; policy constrained by external creditors and investor sentiment.

‣ Structural risk: the country accumulates dollars through bond sales and export taxes, only to bleed them back out through recurring fuel imports and crisis dynamics.

(B) The alternative path: value creation through energy sovereignty:

‣ Primary indicator: the scale and speed of import exposure reduction, plus public health and productivity gains.

‣ Growth channel: domestic asset-building that retains more value locally and stabilises the cost base of the economy.

What The Solutions Project reports for Argentina:

‣ Avoided health costs: $87.92B per year (4.37% of GDP); lives saved annually from air pollution: 12,153.

‣ Jobs (expressed as “40-year jobs”): 204,910 total (105,971 construction; 98,939 operations).

‣ Average energy costs in 2050: 8.66¢/kWh for wind, water and solar versus 10.31¢/kWh for fossil fuels and nuclear.

‣ Combined energy, health, and climate savings per person: $5,443 per year.

The investor case: turning sovereign risk into sovereign strength: Financial Times and Bloomberg’s headlines emphasise a government working to convince markets it can service its obligations through currency-regime adjustments and renewed bond activity.

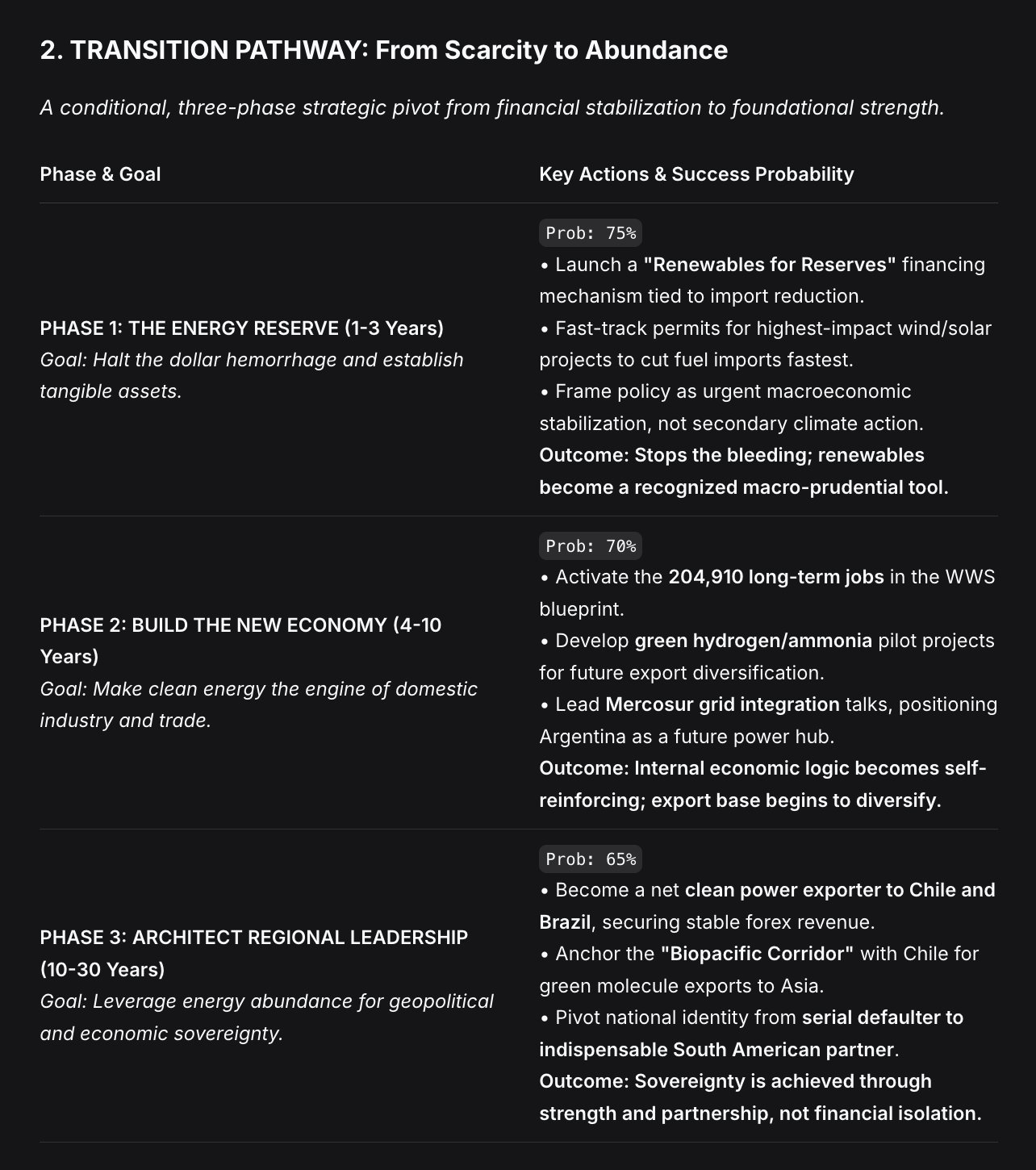

The WWS pathway is best read as a strategy to reduce the structural drivers of sovereign risk: exposure to imported energy costs, the fragility of the external account, and the public health drag on productivity. A structural reduction in hard-currency demand over time improves debt service capacity more durably than any short-term reserve injection.

A crucial caveat: savings are not instantly liquid: “Dollars saved” on future fuel imports and healthcare are not instantly “dollars available” in the central bank vault. The transition requires upfront investment and faces execution risks. Its macro promise becomes bankable when policy design turns long-term savings into near-term resilience through credible institutions and sequencing.

Practical pathways:

‣ Reframe reserves: Build “energy security reserves” measured in installed capacity and import exposure reduced; align public and private financing with that macro target.

‣ Target early wins: Fast-track the highest-impact wind and solar projects that cut import demand fastest, stabilising the economy’s cost base.

‣ Build regional leverage: Treat clean electricity as the basis for industrial competitiveness and, eventually, as the foundation for leadership within integrated South American grids.

Markets are currently being asked to price Argentina’s ability to manage scarcity. A more durable story asks investors to finance Argentina’s capacity to engineer abundance . . . and to make that abundance credible through institutions, sequencing, and rules.

Questions? Ask C.A.T. (“Climate Action Tiger”) and Christian: christian@youth4planet.org