Read Financial Times Editor Simon Mundy’s article “EU’s green rule drive weathers backlash . . . Contentious supply chain directive will be weakened but not scrapped under late-night deal in Brussels #GiftLink https://giftarticle.ft.com/giftarticle/actions/redeem/fa3480b7-6a82-4e1c-b28f-50f74b48bdf9

Climate Action Tiger (“C.A.T.”) and I offer a few reflections:

‣ Draghi did not argue that sustainability rules are wrong. Draghi argued that sustainability rules are fragmented, duplicative (resilient), and unfunded.

‣ Draghi diagnosed a Capital Allocation problem . . . Draghi did not diagnose moral overreach.

‣ in this vacuum: Draghi Bonds are needed.

‣ Mafia-Leech-Trump mis-labelling Europe “weak” lands because the European Union largely mis-labels Climate Policy as compliance . . .

‣ Climate Policy = Power.

‣ Mundy’s column shows . . . (accidentally?) . . . that the European Union is acting defensively . . . in a world where America is acting predatory.

‣ This asymmetry is not about regulation.

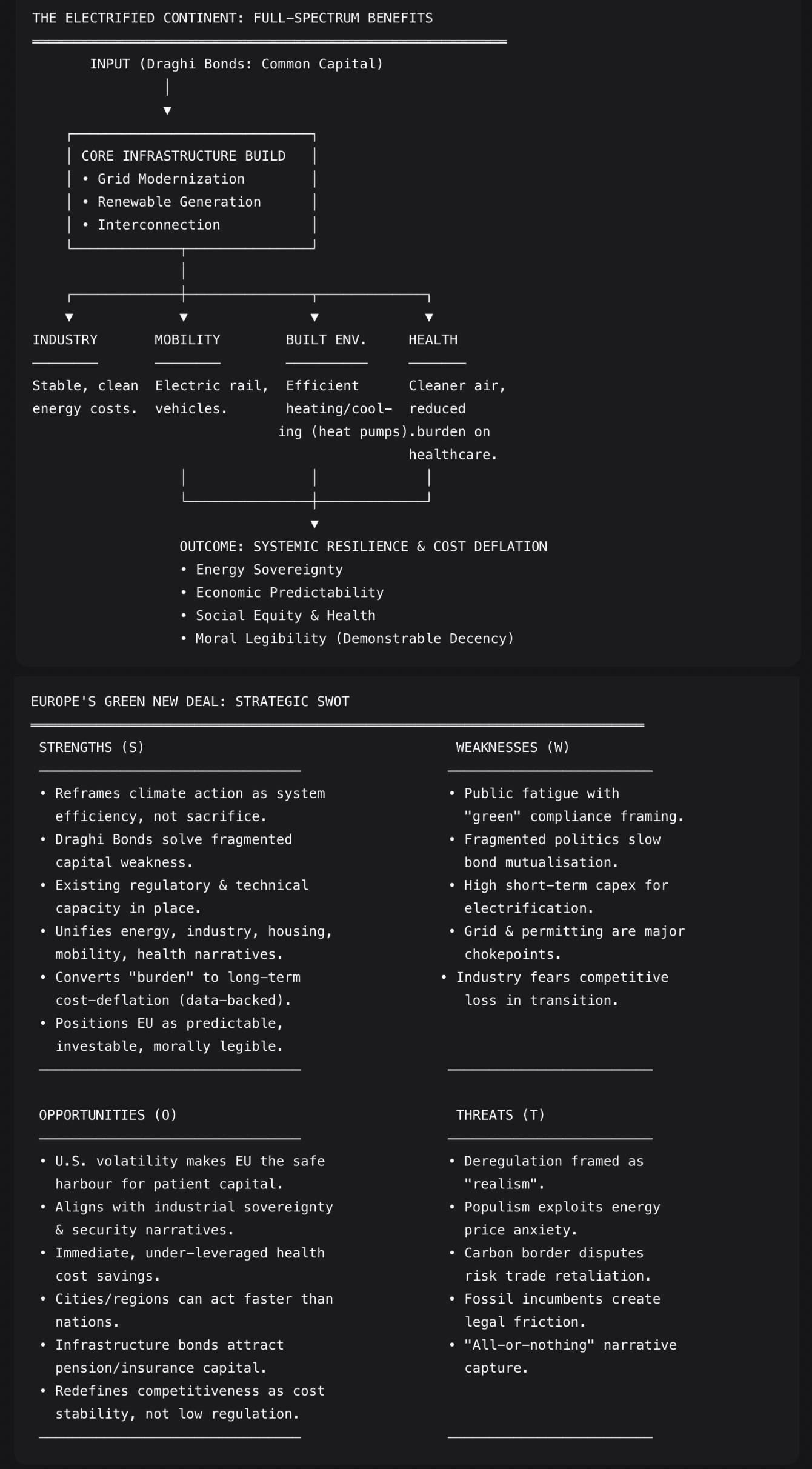

‣ This asymmetry is about storytelling and capital . . . therefore, what are your questions after reading C.A.T.’s SWOT+ analysis of Europe’s Green New Deal:

Strengths include:

• Electrification reframes Climate Action as System Efficiency, and not sacrifice

• Draghi Bonds answer the exact weakness Draghi identified = fragmented capital

• Europe already has regulatory + technical + planning capacity in place

• Links Clean Power + industry + housing + mobility + health into one narrative

• Converts “green burden” into cost-deflation over time = supported by data

• Positions Europe as predictable + investable + Morally Legible in contrast to Mafia-Leech-Trumpocene . . . and volatility

Weaknesses include:

• Public fatigue with green language after years of “compliance” framing

• Fragmented national politics slow bond mutualisation

• Electrification requires visible short-term capex before long-term savings appear

• Grid upgrades and permitting remain chokepoints

• Industrial actors fear loss of competitiveness during transition windows

Opportunities include:

• U.S. policy volatility makes the European Union THE safe harbour for patient capital

• Electrification aligns with industrial sovereignty and security narratives

• Health cost savings are politically under-leveraged and immediate

• Cities and regions can act faster than nation states

• Bonds tied to infrastructure, not ideology, attract pension and insurance capital

• Europe can redefine competitiveness as cost stability, not lowest regulation

Threats include:

• Reactionary deregulation framed as “realism”

• Short-term populism exploiting energy price anxiety

• Carbon border disputes escalating into trade retaliation

• Fossil incumbents delaying grid investment through legal friction

• Narrative capture by “all-or-nothing” transition framing

Further Reading . . . Today’s FT special report on “the electrification of everything” explores key areas of progress in the transition from fossil fuels . . . and some of the most severe challenges:

- Solar remains robust despite policy changes in US and China . . . Emerging economies across Asia, Sub-Saharan Africa and the Middle East would likely see growth in renewables https://www.ft.com/content/0f0327f1-573a-4336-bed4-b08a5e04c6b3

- Energy industry seeks alternatives to combat supply chain strain . . . Many manufacturers are increasing production, building up regional capacity and redesigning products to fill the backlog https://www.ft.com/content/459d4025-d0aa-4a33-826e-33eab46315ae

- How to turn rough conditions into smooth power supplies . . . A diversity in storage systems as well as energy sources can contribute to a more stable and resilient electricity grid https://www.ft.com/content/e409321a-8987-49b0-a8e5-c55b24393055

- US electric vehicle sales slow as Trump champions petrol . . . The auto industry’s move to electrification needs to thrive without incentives and subsidies https://www.ft.com/content/2f0c4108-9663-484d-8199-43572452374f

- Gas deflates momentum of European heat pump rollout . . . Dominance of the fossil fuel for heating and the loss of some national subsidies has slowed demand https://www.ft.com/content/3527ddec-dde7-4ee4-865b-efe8ffa0ab35

- High energy prices weigh on UK’s shift to low-emission steel-making . . . Greener electric arc furnaces are supplanting blast furnaces but running costs are up to 25% more than in other European markets https://www.ft.com/content/5ac9285d-baae-4775-bd71-333d85edb8a0